Trade the US earnings season

The Q4 2025 earnings season can move markets fast. Track upcoming earnings, plan your watchlist, and trade US share CFDs with tools built for active traders.

Most watched this season

Apple • Microsoft • Alphabet • Amazon • Nvidia • Meta • Tesla

Trade the US earnings season with GO Markets

The US earnings season brings a wave of earnings updates from major listed US companies. Results, guidance, and market expectations can shift quickly, driving volatility across individual stocks, sectors, and broader indices.

Competitive pricing

Stay cost-aware when trading around fast-moving reports.

Technical analysis tools

Use charts and indicators to plan entries, exits, and risk.

Built for active trading

Trade with fast execution and a reliable platform.

Risk management controls

Use built-in tools to define downside and protect positions during volatility.

More time to act

Extended hours are available on selected US share CFDs, giving you additional trading time beyond standard market sessions.*

*Availability varies by instrument. Trading conditions may differ outside regular market hours.

Most watched this season

US earnings calendar

Displayed times use Australian Daylight Savings (GMT+11). Change your timezone anytime in the Earnings Calendar settings.

News & analysis

2026 is not giving investors much breathing room. It seems markets may have largely moved past the idea that rate cuts are just around the corner and into a year where inflation may prove harder to control than many expected.

Goods inflation has picked up, while services inflation remains relatively sticky due to ongoing labour cost pressures. Housing costs, particularly rents, also remain a key source of inflation pressure.

The RBA is trying to stay credible on inflation without pushing the economy too far the other way.

Key data

CPI is still around 3.8 per cent (above target), wages are still rising at about 0.8 per cent over the quarter, and unemployment is around 4.1 per cent.

Based on market-implied pricing, rate hikes are not expected soon, so the way the RBA explains its decision can matter almost as much as the decision itself. If the tone shifts expectations, those expectations can move markets.

What this playbook covers

This is a playbook for RBA-heavy weeks in 2026. It covers what to watch across sectors, lists the key triggers, and explains which indicators may shift sentiment.

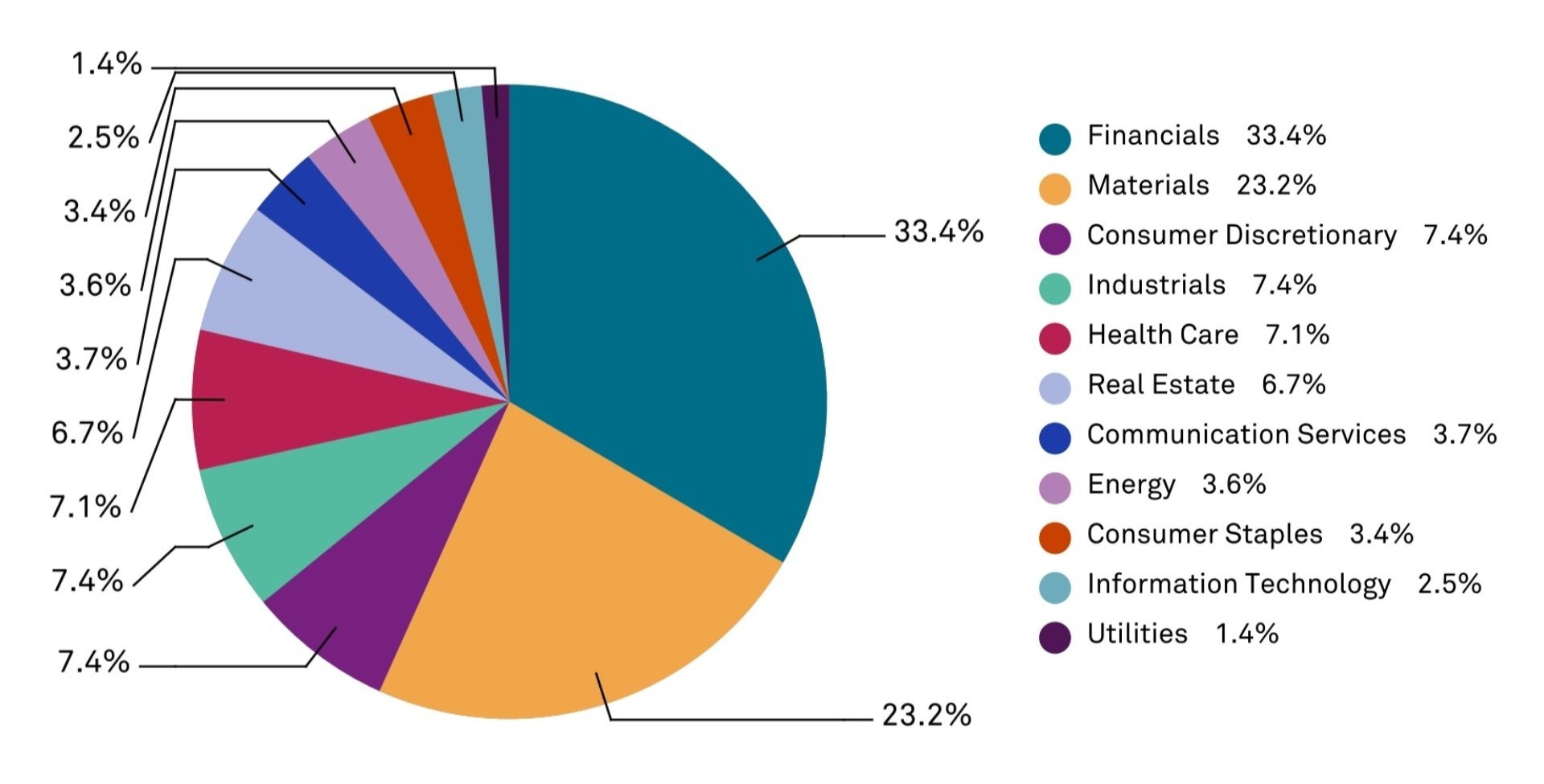

1. Banks and financials: how RBA decisions flow through to lending and borrowers

Banks are where the RBA shows up fastest in the Australian economy. Rates can hit borrowers quickly and feed into funding costs and sentiment.

In tighter phases, margins can improve at first, but that can flip if funding costs rise faster, or if credit quality starts to weaken. The balance between those forces is what matters most.

If banks rally into an RBA decision week, it may mean the market thinks higher for longer supports earnings. If they sell off, it may mean the market thinks higher for longer hurts borrowers. You can get two different readings from the same headline.

What to watch

- The yield curve shape: A steeper curve can help margins, while an inverted curve can signal growth stress.

- Deposit competition: It can quietly squeeze margins even when headline rates look supportive.

- RBA wording on financial stability, household buffers, and resilience. Small phrases can shift the risk story.

Potential trigger

If the RBA sounds more hawkish than expected, banks may react early as markets reassess growth and credit risk expectations. The first move can sometimes set the tone for the session.

Key risks

- Funding costs rising faster than loan yields: May point to margin pressure.

- Clear tightening in credit conditions: Rising arrears or refinancing stress can change the narrative quickly.

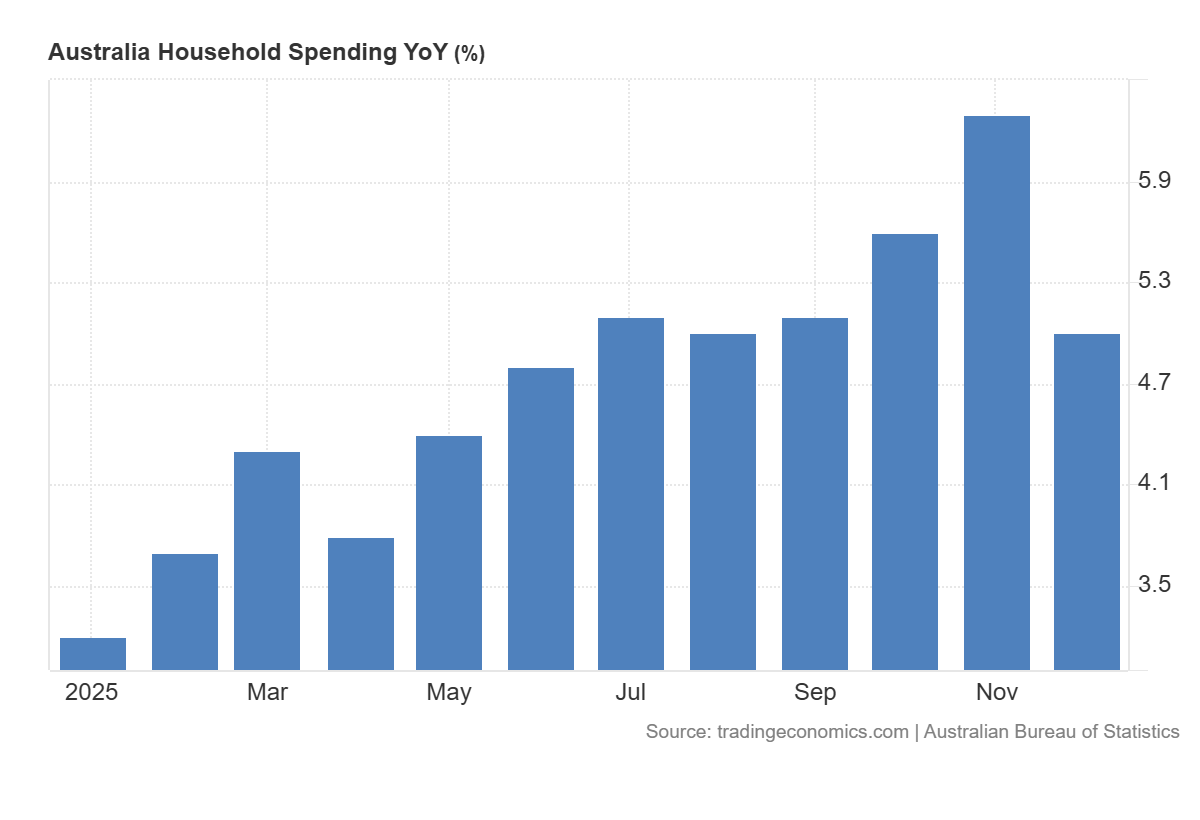

2. Consumer discretionary and retail: where higher rates hit household spending

When policy is tight, consumer discretionary becomes a live test of household resilience. This is where higher everyday costs often show up fastest.

Big calls about the consumer can look obvious until the data stops backing them up. When that happens, the narrative can shift quickly.

What to watch

- Wages versus inflation: The real income push or drag.

- Early labour signals: Hours worked can soften before unemployment rises.

- Reporting season clues: Discounting, cost pass-through, and margin pressure can indicate how stretched demand really is.

Potential trigger

If the tone from the RBA is more hawkish than expected, the sector may be sensitive to rate expectations. Any initial move may not persist, and subsequent price action can depend on incoming data and positioning

Key risks

- A fast turn in the labour market.

- New cost-of-living shocks, especially energy or housing, that hit spending quickly.

3. Resources: what to watch when tariffs, geopolitics, and policy shift

Resources can act as a read on global growth, but currency moves and central bank tone can change how that story lands in Australia.

In 2026, tariffs and geopolitics could also create sharper headline moves than usual, so gap risk can sit on top of the normal cycle.

The RBA still matters through two channels: the Australian dollar and overall risk appetite. Both can reprice the sector quickly, even when commodity prices have not moved much.

What to watch

- The global growth pulse: Industrial demand expectations and China-linked signals.

- The Australian dollar: The post-decision move can become a second driver for the sector.

- Sector leadership: How resources trade versus the broader market can signal the current regime.

Potential trigger

If the RBA tone turns more restrictive while global growth stays stable, resources may hold up better than other parts of the market. Strong cash flows can matter more, and the real asset angle can attract buyers.

Key risks

- In a real stress event, correlations can jump, and defensive positioning can fail.

- If policy tightens into a growth scare, the cycle can take over, and the sector can fade quickly.

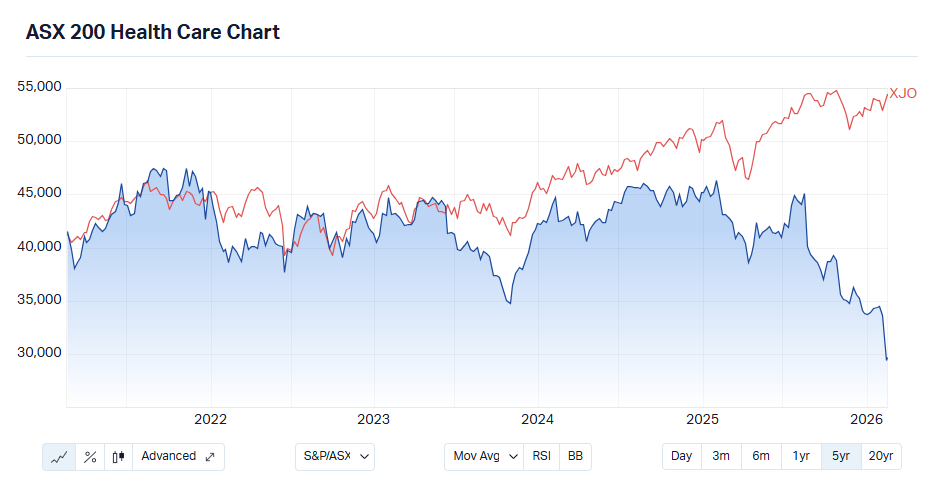

4. Defensives, staples, and quality healthcare

Defensives are meant to be the calmer corner of the market when everything else feels messy. In 2026, they still have one big weakness: discount rates.

Quality defensives can draw inflows when growth looks shaky, but some defensive growth stocks still trade like long-duration assets. They can be hit when yields rise, even if the business looks solid. That means earnings may be steady while valuations still move around.

What to watch

- Relative strength: How defensives perform during RBA weeks versus the broader market.

- Guidance language: Comments on cost pressure, pricing power, and whether volumes are holding up.

- Yield behaviour: Rising yields can overpower the quality bid and push multiples down.

Potential trigger

If the RBA sounds hawkish and cyclicals start to wobble, defensives can attract relative inflows, but that can depend on yields staying contained. If yields rise sharply, long-duration defensives can still de-rate.

Key risks

- Cost inflation that squeezes margins and weakens the defensive story.

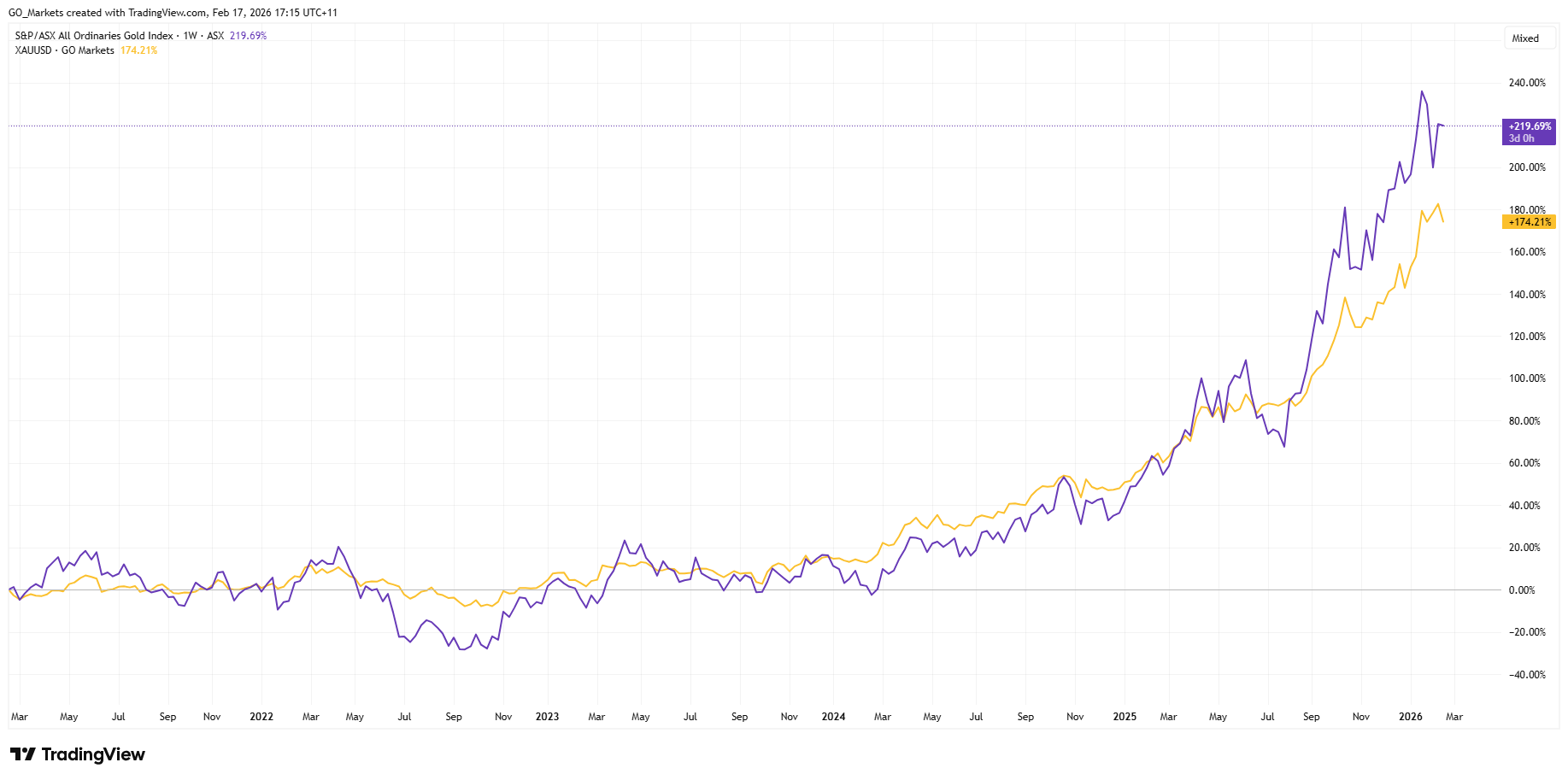

5. Hard assets, gold, and gold equities

In 2026, hard assets may be less about the simple inflation-hedge story and more about tail risk and policy uncertainty.

When confidence weakens, hard assets often receive more attention. They are not driven by one factor, and gold can still fall if the main drivers run against it.

What to watch

- Real yield direction: Shapes the opportunity cost of holding gold.

- US dollar direction: A major pricing channel for gold.

- Gold equities versus spot gold: Miners add operating leverage, and they also add cost risk.

Potential trigger

If the market starts to question inflation control or policy credibility, the hard-asset narrative can strengthen. If the RBA stays restrictive while disinflation continues, gold can lose urgency, and money can rotate into other trades.

Key risks

- Real yields rising significantly, which can pressure gold.

- Crowding and positioning unwinds that can cause sharp pullbacks.

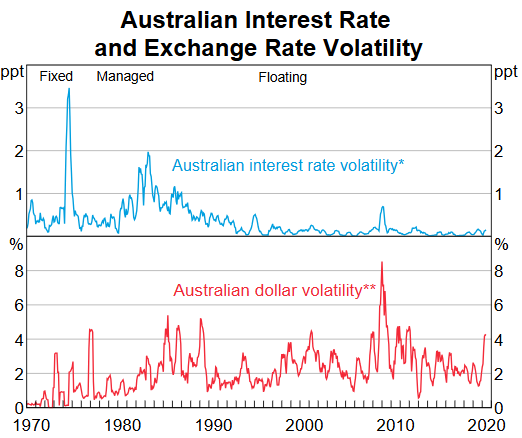

6. Market plumbing, FX, rates volatility, and dispersion

In some RBA weeks, the first move shows up in rates and the Australian dollar, and equities follow later through sector rotation rather than a clean index move.

When guidance shifts, the RBA can change how markets move together. You can end up with a flat index while sectors swing hard in opposite directions.

What to watch

- Front-end rates: Repricing speed right after the decision can reveal the real surprise.

- AUD reaction: Direction and follow-through often shape the next move in equities and resources.

- Implied versus realised volatility: Can show whether the market paid too much or too little for the event.

- Options skew: Can reflect demand for downside protection versus upside chasing.

- Early tape behaviour: The first 5 to 15 minutes can be messy and can mean-revert.

Potential trigger

If the decision is expected but the statement leans hawkish, the front end may reprice first, and the AUD can move with it. Realised volatility can still jump even if the index barely moves, as the market rewrites the path and rotates positions under the surface.

Key risks

- A true surprise that overwhelms what options implied and creates gap moves.

- Competing macro headlines that dominate the tape and drown out the RBA signal.

- Thin liquidity that creates false signals, whipsaw, and worse execution than models assume.

7. Theme baskets

Theme baskets may let traders express a macro regime while reducing single-name risk. They also introduce their own risks, especially around events.

What to watch

- What the basket holds: Methodology, rebalance rules, hidden concentration.

- Liquidity and spreads: Especially around event windows.

- Tracking versus the narrative: Whether the “theme” behaves like the macro driver.

Potential trigger

If RBA language reinforces a “restrictive and uncertain” regime, theme baskets tied to value, quality, or hard assets may attract attention, particularly if broad indices get choppy.

Key risks

- Theme reversal when macro expectations shift.

- Liquidity risk around event windows, where spreads can widen materially.

The point of this playbook is not to predict the exact headline; it is to know where the second-order effects usually land, and to have a short checklist ready before the decision hits.

Keeping these triggers and risks in view may help some traders structure their monitoring around RBA decisions throughout 2026.

FAQs

Why does “tone” matter so much in 2026?

Because markets often pre-price the decision. The incremental information is guidance on whether the RBA sounds comfortable, concerned, or open to moving again.

What are the fastest tells right after a decision?

Some traders look to front-end rates, the AUD, and sector leadership as early indicators, but these signals can be noisy and influenced by positioning and liquidity.

Why are REITs called duration trades?

Because a large part of their valuation can be sensitive to discount rates and funding costs. When yields move, valuations can reprice quickly.

Are defensives always safer around the RBA?

Not always. If yields jump, long-duration defensives can still be repriced lower even with stable earnings.

Why do hard assets keep showing up in 2026 narratives?

Because they can act as a hedge when trust in policy credibility wobbles, but they also carry crowding and real-yield risks.

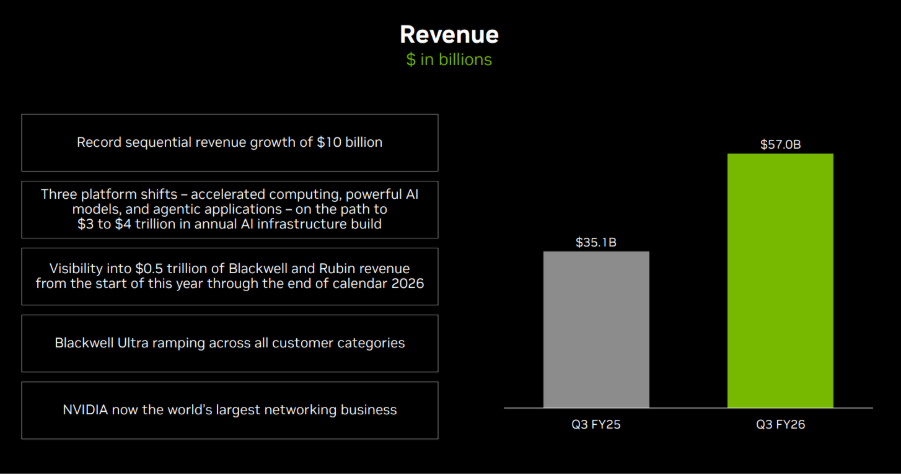

Expected earnings date: Wednesday, 25 February 2026 (US, after market close) / ~8:00 am, Thursday, 26 February 2026 (AEDT)

NVIDIA’s upcoming earnings release is expected to revolve around data centre revenue growth, the sustainability of AI-related demand, gross margin trajectory, and forward guidance into fiscal year 2027 (FY2027).

Markets are likely to focus on capital expenditure trends, supply capacity, and management’s AI infrastructure outlook.

Some market participants may also view NVIDIA’s results as a useful signal for broader AI-related investment sentiment, although outcomes can still be influenced by company-specific factors and wider market conditions.

Key areas in focus

Data centre (AI chips)

The data centre segment continues to be NVIDIA’s primary growth driver. Markets are likely to monitor revenue growth rates, gross margins, and guidance around AI accelerator demand.

Gaming

NVIDIA also sells graphics cards for gaming PCs. Markets will watch whether this part of the business remains steady and profitable, particularly alongside broader consumer and PC-cycle trends.

Automotive and Professional Visualisation

These are smaller divisions linked to AI development, design software and autonomous driving. They are not typically the main driver of near-term results, but commentary may be watched for signs of longer-term growth and product momentum.

Profit margins and costs

Markets will assess how profitable NVIDIA remains, particularly as AI-related investment and supply scaling continue. Margins are one factor closely watched alongside revenue growth, guidance, and broader risk sentiment.

What happened last quarter

In its most recent quarterly update, NVIDIA reported strong year-on-year revenue growth, led primarily by data centre demand.

Management commentary and subsequent reporting referenced ongoing strength in AI accelerator demand and referenced continued supply-scaling initiatives.

Last earnings key highlights

- Revenue: US$57.0 billion

- Earnings per share (EPS): US$1.30 (diluted)

- Data centre revenue: US$51.2 billion

- Gross margin: 73.4%

- Operating income: US$36.0 billion

What analysts expect this quarter

Bloomberg consensus estimates point to continued year-on-year revenue growth in the upcoming report, with markets focused on data centre performance and forward guidance into FY2027.

Bloomberg consensus reference point:

- EPS: about US$1.52

- Revenue: about US$65.5 billion

- Full-year FY2027 EPS: about US$7.66

*All above points observed as of 16 February 2026.

Analysts broadly expect sustained AI-related demand, while attention remains on supply dynamics and the pace of any demand normalisation.

Market-implied expectations

Listed options were pricing an indicative move of approximately ±7% to ±8% around the earnings release, based on near-dated, at-the-money (ATM) options-implied expected-move estimates. Implied volatility was approximately 48% annualised.

What this means for Australian investors

NVIDIA’s earnings may influence near-term sentiment and volatility across major US equity indices, including the NASDAQ 100, with potential spillover into the Asia session following the release.

It may also influence sentiment toward ASX-listed technology-exposed companies and ETFs with exposure to US large-cap growth sectors, although correlations can shift quickly around major events.

Australian-based investors may also wish to factor in AUD/USD currency moves, which can affect the local-currency translation of offshore equities and ETFs.

Important risk note

Immediately after the US close and into the early Asia session, Nasdaq 100 (NDX) futures and related CFD pricing can reflect thinner liquidity, wider spreads, and sharper repricing around new information.

Such an environment can increase gap risk and execution uncertainty relative to regular-hours conditions.

Markets head into the week beginning 16 February with a heavy mix of economic data and ongoing earnings momentum, which will feed into the broader growth picture.

- Flash PMIs (Friday): US, Eurozone, UK and Japan business surveys provide an early read on February growth momentum.

- AI beyond tech: Commentary has increasingly focused on how AI could affect business models across industries, although sector moves can reflect multiple drivers.

- Equity rotation: Recent tech performance has been mixed, and broader participation looks less consistent than a confirmed rotation.

- Earnings: With most US mega caps reported, retail and consumer names are in focus this week, and the Australian reporting season remains busy.

- Bitcoin (BTC): Pulled back after an attempted rebound and remains highly sensitive to shifts in sentiment.

Flash PMIs

Friday’s flash PMI readings across major economies could provide a timely read on business conditions and demand trends.

If services remain resilient while manufacturing stays soft, markets may interpret this as steady but uneven growth. If both weaken, growth concerns could return more quickly.

Earlier in the week, Japan GDP, UK labour data, UK CPI, Australian employment, and US trade data helped set the tone before Friday’s flash PMI releases from multiple countries.

Key dates

- Flash PMIs (US, Eurozone and UK): Friday, 20 February

Monitor

- Currency volatility around PMI releases.

- Bond yield reactions to growth surprises or disappointment.

- Sector and commodity performance shifts that may be tied to changing demand expectations.

AI disruption

Some market commentary has highlighted potential longer-term competitive implications of AI across a range of industries, although company and sector performance can still be driven by macro conditions, rates and earnings expectations.

- Financials: Some discussion has focused on whether AI tools could alter parts of wealth management and advice delivery over time, though share-price moves can reflect multiple influences.

- Logistics and freight: Some market discussion has centred on whether greater automation could affect costs and pricing dynamics over time, alongside other cyclical drivers.

- Software: Reactions remain mixed, with some companies benefiting from AI integration while others face questions about differentiation and pricing power.

This shift means the AI theme could increasingly express itself through relative performance and dispersion, rather than a broad “risk-on” bid.

Monitor

- Earnings guidance that references automation, AI investment, or AI-related competitive pressure.

- Increased dispersion between sectors and within sectors.

- Larger reactions to forward-looking commentary rather than headline beats or misses.

Equity rotation

The rebound in technology shares seen earlier last week has lost momentum. Rather than clear risk-off conditions, the market is showing mixed participation.

Financials, industrials and defensive sectors have attracted flows at times, but not consistently enough to confirm a durable rotation.

Participation remains uneven, and evidence of a more consistent pattern of money flow is still limited at this stage.

Monitor

- Sustained relative strength in non-tech sectors.

- Yield movements and their influence on growth-sensitive equities

- Broader sector participation versus narrow tech leadership

Earnings focus

As the US earnings season moves towards its backend, attention turns toward retail names this week.

Retail results can provide signals about consumer strength, discretionary spending trends and margin resilience, particularly amid mixed perceptions about the state of the economy.

In Australia, reporting season continues, supporting stock-specific volatility across the ASX.

Monitor

- Retail margin commentary and discounting trends

- Consumer demand outlook statements and guidance tone

- Large single-stock moves even when index direction is muted

Bitcoin sentiment-sensitive

Bitcoin has traded lower over recent sessions and remains highly volatile. A move back toward the 5 February low is possible, but prices can change quickly in either direction.

Some market participants view Bitcoin as one indicator of speculative sentiment, although any broader “risk appetite” read-through is uncertain and can be influenced by multiple drivers across crypto markets.

Key economic events

The torch is lit in Milan, and public attention has moved from the opening-ceremony theatrics to the competition on the slopes.

But for forex (FX) traders, eyes are still on the euro (EUR) charts. With Italy at the centre of the sporting world, the eurozone economy is facing one of its most-watched moments of the year.

1. The home court advantage (Italy’s economy)

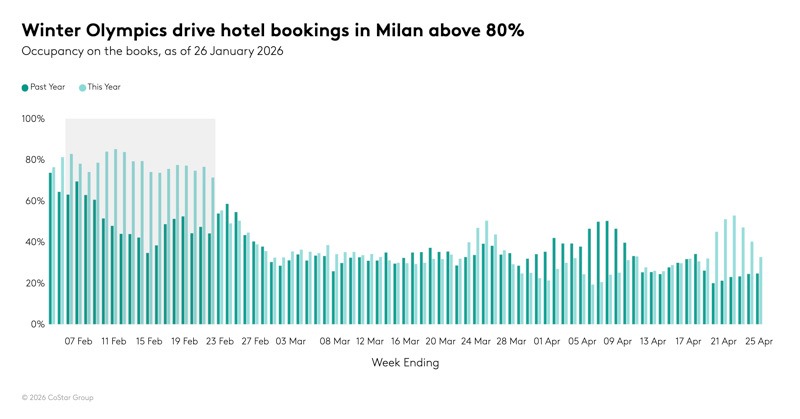

Some estimates suggest the Olympics could deliver roughly a €5.3 billion boost to the Italian economy, driven by direct spending and a longer tourism tail once the flame goes out. In practical terms, that can mean a front-loaded “direct expenditure” phase. Hospitality, retail and transport demand can peak as an estimated 2.5 million spectators move between Milan and the Dolomites.

Checklist task: Watch Italy industrial production (Wednesday, 11 February 2026). While the Games may support services activity, it’s worth tracking whether broader production data is keeping pace or if the Olympic impact is narrowly concentrated in tourism‑linked sectors.

2. The ECB signals

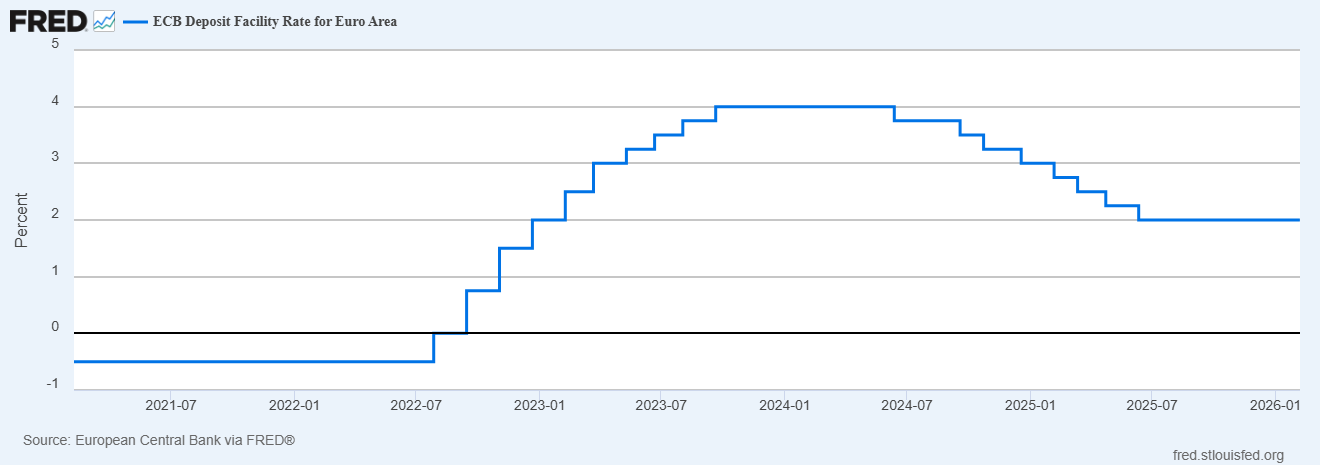

At its 5 February meeting, the European Central Bank (ECB) held policy settings steady at 2.15% and the deposit facility at 2.00%. President Christine Lagarde signalled that while inflation appears to be stabilising, the ECB remains in “wait and see” mode.

Checklist task: Monitor speeches from ECB members this week. Any shift in tone, including a more hawkish tilt that suggests rates may stay higher for longer, could act as a potential tailwind for EUR/USD, especially if it contrasts with a more cautious Federal Reserve tone.

3. Navigate the London-New York overlap

The most prestigious Olympic finals often land in the European evening. For traders, this lines up with the London to New York session overlap (typically 14:00 to 17:00 GMT). That’s when liquidity is deepest in EUR crosses and when positioning can whipsaw around data and headlines.

Checklist task: Expect possible peak liquidity and the potential for “false breakouts” during these hours. If a major US data point (such as Tuesday’s retail sales, or Friday’s CPI) lands while European markets are still open, EUR pairs may see a volatility pickup.

GO Markets week ahead

4. Safe haven slopes

While the euro is the star of the show, the Olympics can still be shadowed by broader geopolitical noise. For example, gold is already trading around the US$5,000 mark after briefly breaking above it in early February, driven by central‑bank buying, expectations of a weaker dollar, and upgraded year‑end forecasts.

Checklist task: If sentiment turns risk-off, watch traditional haven assets such as the Swiss franc (CHF) and gold. Gold has seen large swings recently and is currently testing resistance near US$5,000. EUR/CHF may also see higher volatility if geopolitical headlines intensify during the Games.

5. GDP final standings

The week wraps with the eurozone’s Q4 GDP (second estimate) on Friday, 13 February 2026.

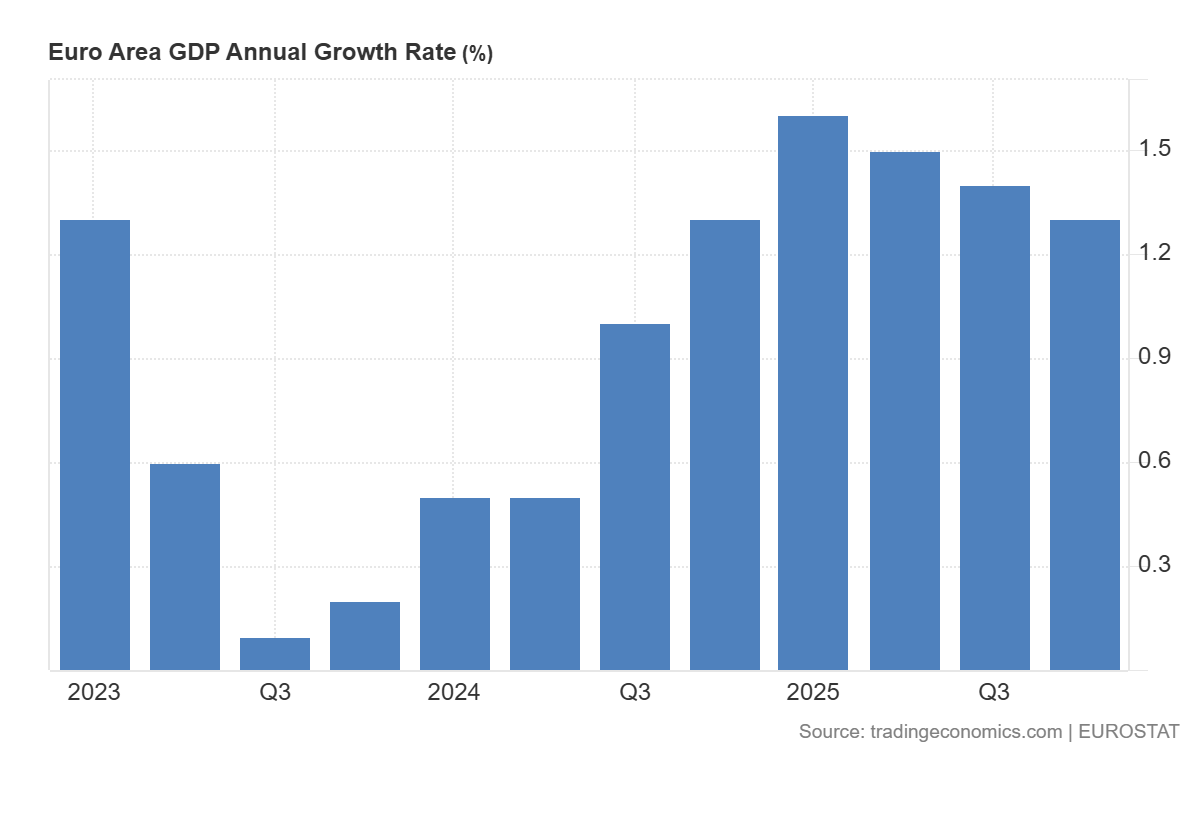

Checklist task: The preliminary estimate showed 0.3% growth. If the figure is revised upward, it may reinforce the eurozone’s resilience and could support a late-week bid in EUR.

Bottom line

While the “Olympic boost” may offer a sentiment cushion for Italy, the euro’s direction is still likely to be shaped by whether the ECB’s “wait and see” stance is challenged by Friday’s GDP update or Wednesday’s industrial production release.

With gold hovering near US$5,000 and the US facing a calendar affected by rescheduled data, volatility could stay elevated into key overlap hours, right as prime-time events are taking place.

Your complete day-by-day guide to Australian medal chances and market-moving moments during the Milano Cortina Winter Olympics.

Quick Facts

- Opening Ceremony: 6:00 am, 7 February AEDT (8:00 pm, 6 February Milan).

- Prime viewing window: 4:00 am to 2:00 pm AEDT daily coincides with pre-market and ASX trading hours.

- Medal ceremonies: Typically run from 6:00 am to 7:00 am AEDT. Perfect for pre-market position adjustments.

- 53 Australian athletes competing: The second-largest Australian Winter Olympic team ever, with 10 genuine medal contenders.

GO Markets Olympic Schedule

Opening Ceremony + first medals - Saturday, February 7

Opening Ceremony at breakfast time, then the first gold medal awarded in primetime on Saturday.

Harry Laidlaw represents Australia in the Men's Downhill, the Games' first Gold medal event, while cross-country skiers Rosie Fordham and Phoebe Cridland compete late Saturday night.

This same-day pairing of ceremony and first medals creates maximum media saturation, with a full weekend news cycle processing before Monday's ASX open.

Key events

- Opening Ceremony: 6:00 am AEDT

- Men's Downhill Final (first gold medal of the games): 9:30 pm AEDT

- Women's 10km + 10km Skiathlon: 11:00 pm AEDT

For traders

- NEC (Nine Entertainment): Double viewership event. Opening Ceremony 6:00 am Saturday, lines up for the peak morning TV audience. First medals at 9:30 pm are a primetime Saturday night.

- Italian equities (FTSE MIB): Historically underperform during domestic Olympics. Turin 2006 saw -2.1% during the Games.

- STLA (Stellantis): ESG headline risk if environmental groups target the ceremony.

- Apparel sponsor arbitrage: If a non-favourite wins Men's Downhill, their sponsor sees average +2.3% pop (PyeongChang 2018, Beijing 2022 data).

First medals continue - Sunday, February 8

The medal rush continues on Sunday as 19-year-old Valentino Guseli takes flight in Men's Snowboard Big Air, offering Australia an early podium chance in one of the Games' most visually spectacular events.

With the ceremony glow still fresh, Guseli's performance sets the tone for Australia's snowboard campaign and could influence Monday's ASX open positioning for action sports stocks.

Key events

- Men's Snowboard Big Air Final (Valentino Guseli): 5:30 am AEDT

- Women's Normal Hill Individual Final: 5:57 am AEDT

For traders

- MNST (Monster Beverage): Action sports sponsor, benefits from multi-athlete Olympic presence.

- FL (Foot Locker), ZUMZ (Zumiez): Youth retail action sports exposure. Guseli gold could create a temporary buzz.

Monday, February 9

A rare quiet day in Australia's Olympic calendar. No Australian medal events are scheduled, making this a pure observation day for traders.

Monitor how Guseli's weekend result is processed through Monday's ASX open, and position ahead of Tuesday's Coady showdown.

Tuesday, February 10

Tess Coady attempts to upgrade her 2022 bronze to gold in Women's Snowboard Big Air. The Tuesday morning timing offers traders a potential pre-market positioning window, though Coady's modest mainstream profile limits exposure compared to the moguls stars on the following day.

Key events

- Women's Snowboard Big Air Final: 5:30 am AEDT

For traders

- FL (Foot Locker), ZUMZ (Zumiez): Youth retail. Coady gold could create a temporary buzz.

- MNST (Monster Beverage): Less volatile, general action sports sponsor.

Wednesday, February 11

The calm before Jakara Anthony. No Australian events on Wednesday means traders spend the day positioning for the biggest moment of the Games: Anthony's moguls final just past midnight.

Moguls Finals - Thursday, February 12

The biggest moment of the Games for Australia arrives just after midnight on Wednesday with Jakara Anthony defending her Olympic crown in the Women's Moguls Final.

As the nation's brightest gold medal hope with 26 World Cup victories, Anthony's 12:15 am performance is the single highest-impact potential event for NEC and VFC stocks across the entire Olympic fortnight.

Matt Graham also chases his first Olympic gold at 10:15 pm Thursday night. Both events carry high NEC and VFC volatility potential.

Key events

- Women's Moguls Final (Jakara Anthony): 12:15 am AEDT

- Men's Moguls Final (Matt Graham): 10:15 pm AEDT

For traders

- NEC (Nine Entertainment): Monitor overnight results and viewership for Thursday open direction.

- VFC (VF Corp/North Face): Sponsors both athletes. A double medal could bring a larger impact.

- Defending champion volatility: An Anthony loss could create higher emotional swings.

- Social sentiment: Track Twitter/Google Trends Thursday morning to gauge the magnitude of Anthony’s performance.

Friday, February 13

Snowboard cross takes centre stage with two Australian medal chances bookending Friday's trading day.

Adam Lambert's overnight final sets the morning open, while Josie Baff's evening showdown takes the Aus prime time slot.

Key events

- Men's Snowboard Cross Finals: 12:56 am AEDT

- Women's Snowboard Cross Finals: 7:30 pm AEDT

For traders

- NEC sentiment gauge: If Lambert medals Fri morning and Graham medaled Thu night, it could create positive momentum.

Jakara Anthony competes - Saturday, February 14

Jakara Anthony goes for the double in Saturday night's Women's Dual Moguls Final.

If she claims gold Thursday and again here, the "double gold Jakara" narrative writes itself, offering geometric rather than linear media value.

Key events

- Women's Dual Moguls Final (Jakara Anthony): 9:46 pm AEDT

For traders

- NEC narrative power: "Double gold Jakara" could draw in more casual viewers.

- If Anthony silver/bronze Thu: Redemption story potential.

- Weekend timing: Saturday night result = Monday ASX gap.

- Format risk: Monitor qualifying rounds; if margins are greater than 1 second (blowouts), engagement could drop.

Sunday, February 15

A quiet Sunday offers redemption arcs and low-impact action. Brendan Corey's morning short track effort carries minimal stock relevance, while Matt Graham's late-night dual moguls final provides a second medal chance after Friday's traditional event.

Key events

- Short Track Speed Skating 1500m Final: 8:42 am AEDT

- Men's Dual Moguls Final: 9:46 pm AEDT

For traders

- VFC second opportunity: If Graham misses on Friday’s moguls, dual moguls redemption is possible.

Monday, February 16

Harry Laidlaw returns to the slopes for late Monday night slalom action, but alpine skiing holds minimal sway over Australian audiences.

This is a placeholder day in the trading calendar, with markets more focused on digesting the weekend moguls results and positioning for Tuesday's monobob final.

Key events

- Men's Slalom: 11:00 pm AEDT

Bree Walker competes - Tuesday, February 17

Bree Walker could make Olympic history as she competes in the Women's Monobob Final, chasing Australia's first-ever bobsleigh medal.

While the narrative is powerful, the commercial reality is that bobsleigh has no retail sponsor footprint, limiting direct stock plays.

Key events

- Pairs Figure Skating Final: 6:00 am AEDT

- Women's Monobob Final: 7:06 am AEDT

For traders

- NEC: Bobsleigh historically gets low ratings, but a Walker gold could provide value as an Australian-first.

Wednesday, February 18

Veterans Laura Peel and Danielle Scott take centre stage on Wednesday night in an event with proud Australian history (2 golds since 2002). However, aerials' niche appeal and late-night timing may limit market impact.

Key events

- Women's Aerials Final: 9:30 pm AEDT

- Women's Slalom Final: 11:30 pm AEDT

For traders

- NEC: If either medals, potential for a small sentiment boost.

- VFC exposure: Limited potential as aerials athletes are less commercially developed.

Thursday, February 19

Thursday night aerials effort is a low-impact finale event with minimal medal expectation for Australian Reilly Flanagan, and even less market relevance.

Scotty James' Saturday halfpipe showdown is the real conversation as the games begin winding down, although a medal run from Flanagan could create an underdog narrative.

Key events

- Men's Aerials Final: 9:30 pm AEDT

Friday, February 20

The final calm before Scotty James' legacy-defining Saturday. Set up day for James' 5:30 am Saturday halfpipe final, the Games' last major potential volatility event for an Aussie athlete.

Scotty James competes - Saturday, February 21

Scotty James' legacy moment arrives Saturday morning. He’s represented Australia at five Olympics, with two medals and zero golds. This is his final chance and brings with it the Games' most emotionally charged event, and the last major trading catalyst before Monday's Closing Ceremony.

Key events

- Men's Snowboard Halfpipe Final (Scotty James): 5:30 am AEDT

- SkiMo Mixed Relay: 11:30 pm AEDT

For traders

- NEC: Potential weekend delays on price discovery. If James gold Saturday.

- NKE (Nike): Potential halo effect from gold via action sports lift.

- Guseli wildcard: Valentino is also competing (his second event after Big Air, Feb 8). A dual medal could create narrative amplification.

Sunday, February 22

Sixteen-year-old Indra Brown takes the Sunday morning spotlight in Women's Freeski Halfpipe, facing off against favourite Eileen Gu (CHN) in what could become a Gen-Z brand inflection point.

Key events

- Women's Freeski Halfpipe Final (Indra Brown): 5:30 am AEDT

- Two-Woman Bobsleigh Final: 7:05 am

For traders

- Mon-Tue watch: Monitor which brands announce Brown signings.

- MILN (Global X Millennials ETF): Action sports retailers, social platforms exposure for Gen Z.

Closing Ceremony - Monday, February 23

The curtain falls on Milano Cortina 2026 with Monday morning's Closing Ceremony, and history says this is where euphoria dies.

- Men's Ice Hockey Final (NHL Superstars): 12:10 am AEDT

- Closing Ceremony: 6:00 am AEDT

Markets to watch:

- French Alps 2030 rotation: Closing features handover to France.

- Australian medal count: If greater than 4 medals (Beijing total), the government may increase 2030 winter sports funding.

- Ice Hockey Final: NHL players compete for the first time since 2014. Major US/Canada viewership means a potential CMCSA boost.

Global markets move into the new week with a number of potentially high-impact catalysts. Japan’s general election lands first on Sunday, followed by US inflation and labour market data that continue to shape interest-rate expectations.

- Japan election: Policy continuity and political stability are generally viewed as supportive for regional markets.

- US inflation and labour market: The consumer price index (CPI) and the Employment Situation report (nonfarm payrolls, NFP) are the immediate macro focal points for the week.

- Bitcoin risk gauge: Bitcoin is back near levels last seen in late 2024 and remains well below its October 2025 peak.

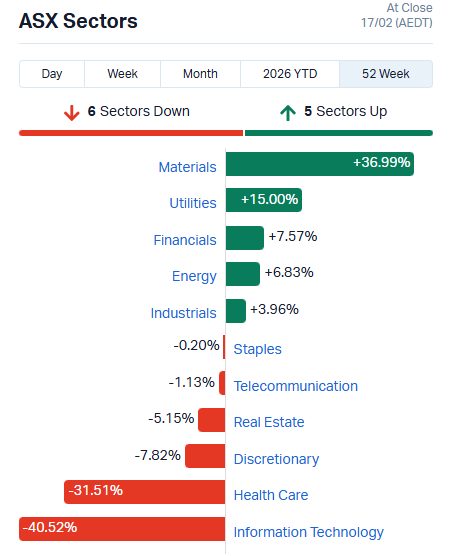

- Sector rotation watch: Technology has recently underperformed while value and defensive segments have stabilised, with earnings season continuing to influence flows.

Japan election

The general election in Japan is primarily viewed through the lens of policy certainty. Markets typically favour a clear outcome and continuity in fiscal and monetary settings.

Unexpected results or coalition uncertainty may increase short-term volatility in the JPY and regional indices at the start of the week.

Key dates

- General election (Japan): Sunday, 8 February

- Results through Asian trade on Monday

Market impact

- JPY may be sensitive to results uncertainty or potential changes in policy direction

- Asia equities may see early-week volatility until results are clear

US inflation and labour market

Inflation remains the most direct input into interest-rate expectations, while the monthly NFP report provides a broad read on employment conditions and wage pressures.

Treasury yields and the USD often react quickly to these releases, with knock-on effects across equities, gold and growth assets.

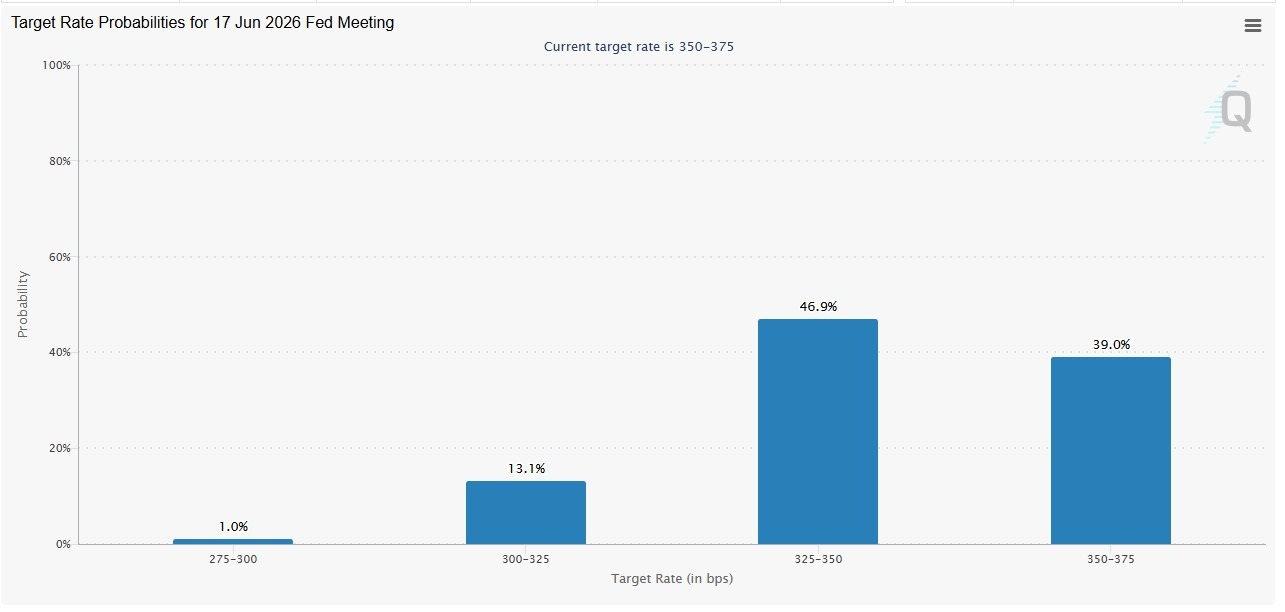

Current pricing indicates markets assign less than a 30% probability of a cut by the April meeting, with June meeting hike probabilities above 50%.

Key dates

- Employment Situation: Wednesday, 11 February 08:30 (ET) | Thursday, 12 February 00:30 (AEDT)

- CPI (January 2026): Friday, 13 February 08:30 (ET) Saturday, 14 February 00:30 (AEDT)

Market impact

- Yields often move first, followed by USD and then risk assets

- Expectations for rate-cut timing may adjust quickly

- Growth and technology shares remain more rate-sensitive

Bitcoin

Bitcoin has declined to levels last seen prior to the US elections in November 2024 and is close to 50% below its October 2025 peak.

While not a traditional macro indicator, crypto markets could be viewed as a real-time read on investor risk tolerance. Sustained weakness can coincide with more cautious positioning across higher-beta assets, including technology shares.

Market impact

- Softer crypto sentiment may coincide with reduced speculative flows

- Risk appetite may remain more selective

Sector rotation

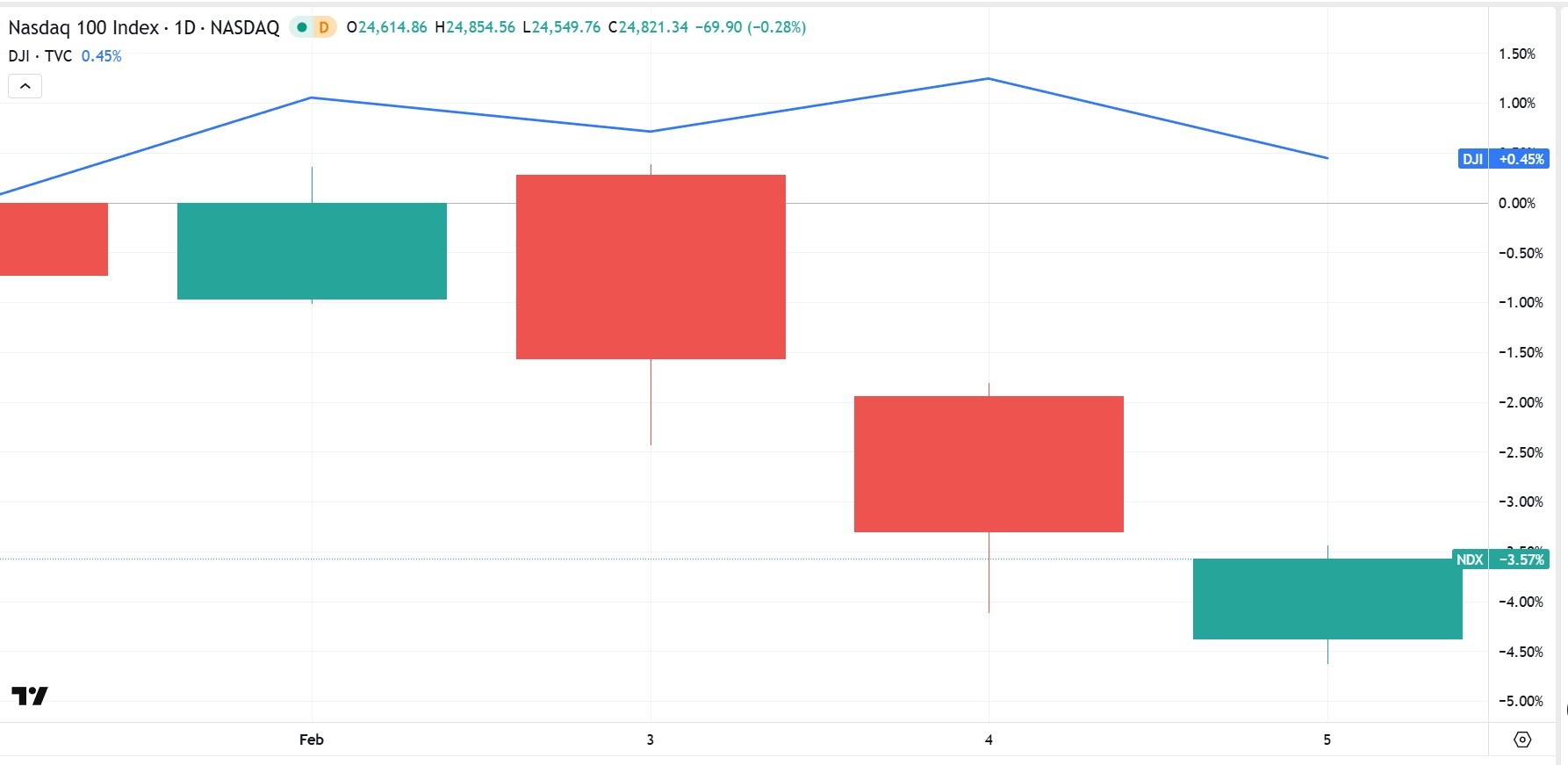

Over the past week, the Dow Jones Industrial Average has outperformed, trading just below neutral, while the Nasdaq-100 has declined more than 4%, reflecting sensitivity in large-cap technology to firmer yields.

What the move may reflect

- Rate-driven pressure on growth stocks

- Profit-taking after strong tech performance

- Earnings season favouring broader sector participation

- A generally more cautious tone across higher-beta assets

Markets typically look for sustained multi-week outperformance in financials, industrials or defensives before characterising the shift as structural rotation.

Market impact

- Tech remains more sensitive to yield moves

- Value and defensive sectors may see relative support

- Earnings guidance continues to influence leadership