Trading strategies

Explore practical techniques to help you plan, analyse and improve your trades.

Our library of trading strategy articles is designed to help you strengthen your market approach. Discover how different strategies can be applied across asset classes, and how to adapt to changing market conditions.

From tech disruptors to defence contractors, some of the market's most talked-about companies start their public journey through an initial public offering (IPO). For traders, these initial public listings can represent a unique trading environment, but also a period of heightened uncertainty.

Quick facts

- An IPO is when a private company lists its shares on a public stock exchange for the first time.

- IPOs can offer traders early access to high-growth companies, but come with elevated volatility and limited price history.

- Once listed, traders can gain exposure to IPO stocks through direct share purchases or derivatives such as contracts for difference (CFDs).

What is an initial public offering (IPO)?

An IPO is when a company offers its shares to the public for the first time.

Before performing an IPO, shares in the company are typically only held by founders, early employees, and private investors. Going public makes the shares available to be purchased by anyone.

Depending on the size of the company, it will usually list its public shares on the local stock exchange (for example, the ASX in Australia). However, some large-valuation companies choose to only list on a global stock exchange, like the Nasdaq, no matter where their main headquarters is located.

For traders, IPOs are generally the first opportunity to gain exposure to a company’s stock. They can create a unique environment with increased volatility and liquidity, but also carry heightened risk, given the limited price history and sensitivity to sentiment swings.

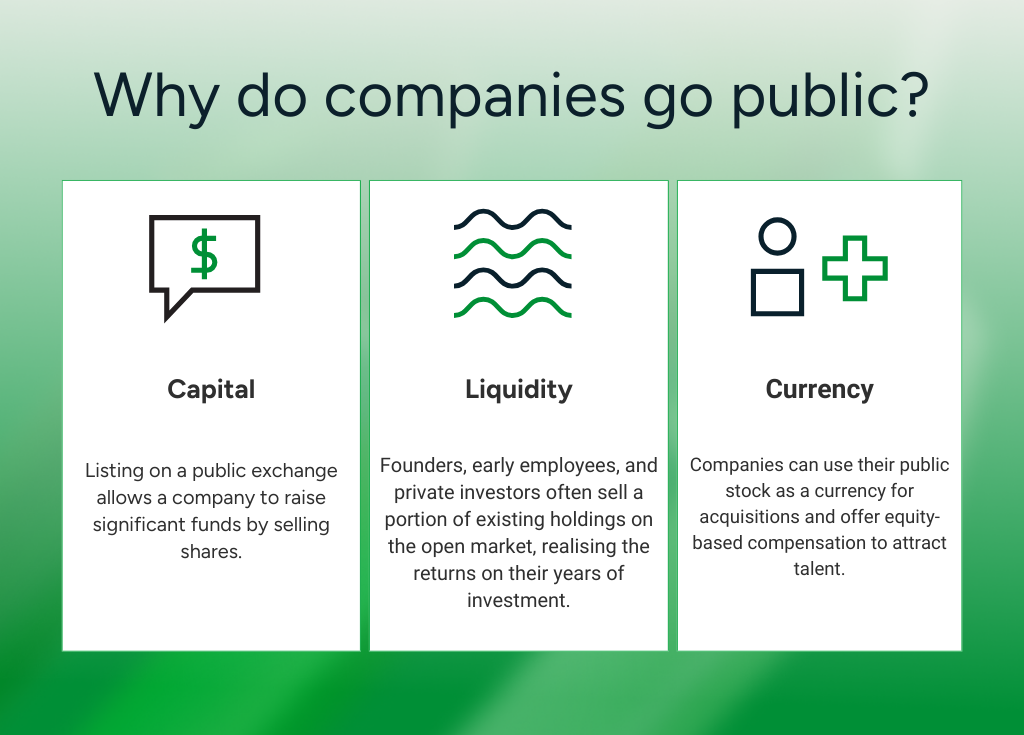

Why do companies go public?

The biggest driver to perform an IPO is to access more capital. Listing on a public exchange means the company can raise significant funds by selling shares.

It also provides liquidity for existing shareholders. Founders, early employees, and private investors often sell a portion of their existing holdings on the open market, realising the returns on their years of support.

Beyond the monetary benefits, going public means companies can use their stock as currency for acquisitions and offer equity-based compensation to attract talent. And a public valuation provides a transparent benchmark, which is useful for strategic positioning and future fundraising.

However, it does come with trade-offs. Public companies must comply with ongoing disclosure and reporting obligations, and pressure from public shareholders can become a barrier to long-term progress if many are focused on short-term performance.

How does the IPO process work?

While the specifics vary by jurisdiction, going from a private company to a public listing generally involves the following stages:

1. Preparation

The company first selects the underwriter (typically an investment bank) to manage the offering. Together, they assess the company's financials, corporate structure, and market positioning to determine the best approach for going public. It is the heavy planning stage to make sure the company is actually ready to go public.

2. Registration

Once everything is prepared, the underwriters conduct a thorough due diligence check and then lodge the required disclosure documents with the relevant regulator. These documents give a detailed disclosure to the regulator about the company, its management, and its proposed offering. In Australia, this is typically a prospectus lodged with ASIC; in the US, a registration statement filed with the SEC.

3. Roadshow

Executives at the company and underwriters will then present the investment case to institutional investors and market analysts in a “roadshow”. This showcase is designed to gauge demand for the stock and help generate interest. Institutional investors can register their interest and valuation of the IPO, which helps inform the initial pricing.

4. Pricing

Based on feedback from the roadshow and current market conditions, the underwriters set the final share price and determine the number of shares to be issued. Shares are allocated on the ‘primary market’ to investors participating in the offer (before the stock is listed publicly on the secondary market). This process sets the pre-market price, which effectively determines the company’s initial public valuation.

5. Listing

On listing day, the company’s shares begin trading on the chosen stock exchange, officially opening the secondary market. For most traders, this is the first point at which they can trade the stock, either directly or through derivatives such as Share CFDs.

6. Post-IPO

Once listed, the company becomes subject to strict reporting and disclosure requirements. It must communicate regularly with shareholders, publish its financial results, and comply with the governance standards of the exchange on which it is listed.

IPO risks and benefits for traders

How do traders participate in IPOs?

For most traders, participating in an IPO comes once shares have listed and begun trading on the secondary market.

Once shares are live on the exchange, investors can buy the physical shares directly through a broker or online exchange, or they can use derivatives such as Share CFDs to take a position on the price without owning the underlying asset.

The first few days of IPO trading tend to be highly volatile. Traders should ensure they have taken appropriate risk management measures to help safeguard against potential sharp price swings.

The bottom line

IPOs mark when a company becomes investable to the public. They can offer early access to high-growth companies and create a unique trading environment driven by elevated volatility and market interest.

For traders, understanding how the process works, what drives pricing and post-IPO performance, and how to weigh potential rewards against the risks of trading newly listed shares is essential before taking a position.

The US Dollar Index (DXY) is a popular tool used by forex traders to assess the value of the US dollar relative to a basket of other major currencies. The DXY is calculated using the weighted average of six major currencies: the euro, yen, pound sterling, Canadian dollar, Swedish krona, and Swiss franc. To use the DXY to trade forex, you can follow these steps: 1.

Monitor the DXY: Keep an eye on the movements of the DXY to get a sense of the overall strength or weakness of the US dollar. You can use technical analysis tools, such as moving averages or trend lines, to identify the direction of the trend. 2. Analyse currency pairs Look for forex pairs that are inversely correlated to the DXY.

This means that when the DXY goes up, the currency pair goes down, and vice versa. For example, the EUR/USD pair is negatively correlated to the DXY, which means that as the DXY goes up, the EUR/USD pair goes down. Plan your trades Once you have identified a currency pair that is inversely correlated to the DXY, you can plan your trades accordingly.

For example, if the DXY is showing signs of weakness, you may want to consider going long on a negatively correlated currency pair, such as the EUR/USD. Manage your risk As with any trading strategy, it's important to manage your risk when using the DXY to trade forex. Make sure to use stop-loss orders to limit your losses in case the market moves against you.

Currency pairs may be influenced by other factors besides the DXY, which may not be a perfect indicator of the US dollar's value. To make informed trading decisions, it is important to combine the DXY with other technical and fundamental analysis tools.

Bollinger Bands are one of the most popular indicators that FX and CFD traders use, invented in the 1980’s they are a technical analysis tool that are widely used by short and long term traders. The main uses for Bollinger Bands is determining turning points in the market at oversold and overbought levels and also as a trend following indicator. Like any technical indicator Bollinger Bands should be used with your own analysis to confirm trades and help set entry and exit levels, they are a fairly simple indicator that focuses on price and volatility only and shouldn’t, in my opinion be used in isolation.

While effective, to use them successfully you will need to be aware of the fundamentals and other technical indicators such as major support or resistance levels. How Bollinger Bands are calculated Bollinger Bands are composed of three lines. The middle line is a simple moving average (SMA), the default period being 20.

The upper and lower bands are the SMA plus or minus 2 standard deviations by default, the SMA period and Deviations can be adjusted in the settings of the indicator if desired, but the standard settings are the most popular settings among traders. When the price hits the upper band the market could be seen as “overbought” when it hits the lower band it could be seen as “oversold”, they can also be used as levels where trends are confirmed, e.g. hitting upper band could be seen as the start of a strong uptrend and vice versa. Day Trading strategies using Bollinger Bands Bollinger Bands are used mainly in two different trading styles, for contrarians looking for overbought and oversold levels to enter fade trades, or confirmation of trend for trend following systems. Both systems have their pros and cons, as with most indicators it will depend on the market “fee” for the time used, a choppy whipsawing market will see the fading system work very well, a strong trending market will see the trend following system work very well.

As with any technical system, the selection of the market to trade and being aware of the fundamentals driving the FX market at that time are critical.. Just had a Fed meeting where they surprised with a 100bp rate hike? Don’t use the fade system on USD pairs!

A good technical system I have found is useful is a mixture of both of these strategies, using the Bollinger Bands to confirm a trend, then using the fading strategy to trade pullbacks of this trend. Lets look at the example below from the AUDNZD – 5 minute chart from the 23 rd March 2023 In the above example, which is a common price action across all FX pairs, you would be using the Bolling Bands to confirm a down trend after a close below a major low. Once the possible trend is confirmed, we will be using the “overbought” level of the upper band to enter a short trade, with a take profit exit on 2 closes below the lower band, indicating the market may have gone into “oversold” territory and was time to take some money off the table.

This process would be repeated while lower highs were being made, a close above a major recent high along with a close above the upper Bollinger Band would indicate the trend may have come to an end. This can be seen on the chart below, later in the session on the same pair. At this point you would exit the short selling of the down trend and reverse to a long bias, or if your analysis on fundamentals were negative for this pair, wait for a new downtrend to form for another shorting run.

The Bollinger Squeeze Strategy Another strategy popular with FX traders is known as the Bollinger squeeze strategy. A squeeze occurs when the price has a big move, then consolidates in a tight range, this also sees the Bollinger bands go from wide to “squeeze” in a much narrower range, hence the name of the strategy. A trader would be looking for a breakout and close below or above the Bollinger bands of this squeezed range for a trade entry, see the example below from the EURUSD 5 Minute chart on 23 rd of March 2023 When the price breaks through the upper or lower band after this period of consolidation a buy or a sell signal is generated.

An initial stop is traditionally placed just above (or below in a long position) the range of the consolidation. TP rules could be similar to the previous strategy, i.e. multiple closes below the lower Bollinger Bans in the case of a short, or using the middle Bollinger Band as a trailing stop in the move is explosive and looks to continue. Summary As you can see there are multiple uses for Bollinger Bands in a FX day traders toolbox, including using them for overbought and oversold trade signals in a trending market and the Squeeze strategy where an explosive move often follows a period of consolidation.

There are also many more strategies using this indicator which I encourage you to research for yourself.

军形篇 - The Chapter of Tactical Dispositions Original Text: 善战者,先为不可胜,以待敌之可胜。 Translation: Good commanders first evaluate the possibility of being defeated and then wait for an opportunity to defeat the enemy. Don’t you think this sounds very similar to using a trading stop-loss? The concept of setting up a stop-loss is to estimate and prepare for the worst case scenario.

As a commander, Master Zhu would suggest you treat the money in your account as your soldiers and take care of their lives. Let's say you're on the battlefield and you strategize that a plan of attack might sacrifice 50% of your army, that's 50% of your soldiers' lives (i.e., 50% of your account balance), surely no respected commander would approve that kind of attack. However, in forex trading, some people will quickly lose 50% of their money in a short period.

In Sun Zhu's eyes, this would make for a very unqualified commander. Therefore, placing a stop-loss that could cause you to lose 50% in a single trade is a poor decision. Most experienced traders might suggest a 2%~5% stop is a wiser move.

Even a 10% stop may be considered quite extreme. Would you risk the lives of 10% of your infantry? Some might argue that it depends on the circumstances, either way, the same level of consideration must be given in trading to have any chance of success.

Also, most traders lose 50% of their account or more because they fail to place any stop-loss measures at all. Under the context of the Art Of War, this means you never bothered to estimate the worst scenario before you attacked. In Master Sun’s eyes, that is extremely unacceptable.

Original Text: 不可胜在己,可胜在敌。 Translation: The ability to secure ourselves against defeat lies in our own hands. The opportunity to defeat the enemy is provided by themselves. A very remarkable concept.

Many investors believe they can actively beat the market, which is wrong. The market is far stronger and smarter beast than the average person. Instead of trying to "beat" the market, more time and effort should go into improving yourself.

For example, try focussing on how to better to defend, such as setting up suitable stop-losses as the previous saying suggests. Once you've developed the ability to protect your soldiers, then all you need is to do is wait for an opportune time to attack (you can observe it from chart patterns), then and only then, will you be trading like an intelligent commander, prepared to lose a battle and win the war. Original Text: 故善战者,能为不可胜,不能使敌之必可胜。 Translation: Thus, a good commander can secure himself against defeat but cannot make sure of defeating the enemy.

Master Sun corrects us here on another common misunderstanding. Nowadays many fund managers will brag about their “target profit” to attract your attention. As an individual investor, you might be vulnerable to being misled and start to think “maybe it's good to set a target profit for my investing too?.” Well, Sun Tzu would argue that this is wrong.

If you set a target return for yourself and you are unable to achieve it, you will most likely become hurried and vulnerable. Imagine your basketball team is losing and it's the last few minutes of the game. How many times have we seen teams abandon their defensive tactics, throwing caution to the wind and put everything they have into the final attack?.

Perhaps having Michael Jordan on the court may help, but ultimately, this scenario doesn't end well for those losing teams. With little to no defense in place, the opposing team will typically score more points and much more easily than before making matters worse. The same logic applies to the financial markets.

There is a general tendency to increase your position and attack more at the worst possible time, and the market will more often punish those who fail to defend their position adequately. Original Text: 故曰:胜可知,而不可为。 Translation: Hence the saying: You may know how to win, but sometimes you are not able to do it. Original Text: 见胜不过众人之所知,非善之善者也; Translation: To see victory only when it is within the ken of the common herd is not the acme of excellence.

Original Text: 战胜而天下曰善,非善之善者也。 Translation: Neither is it the acme of excellence if you win and the whole world says, “Well done!” to you. In this paragraph, Sun illustrates another common misunderstanding by the general public. You probably heard of the 20-80 rule, which states that roughly 20% of the population controls 80% of the global wealth.

You may have also heard that 20% of the population will win at trading while the other 80% will lose. When it comes to trading, this theory suggests the most popular idea about price direction will cause you to lose money in the long run. Thus, if your opinion falls within the common herd, then perhaps you need further training as a trader.

Many beginner traders will follow those famous pundits on the major television stations. You know the ones I'm talking about, those who claim they can predict the market direction with 80% accuracy and never fail. If we consider the 20-80 rule above, then this claim starts to sound quite absurd or should at least raise some internal alarm bells.

Most of these analysts have a claim to fame because they successfully predicted one or two big financial events, say the start of the 2008 crisis. Does this mean they can accurately predict every other upcoming event with such accuracy? Of course not, nobody can.

Hence, Sun Zhu said those who won the applause of the whole world might not be as good as you think. Original Text: 故举秋毫不为多力,见日月不为明目,闻雷霆不为聪耳。 Translation: To lift a hair is no sign of immense strength; to see the sun and moon is no sign of sharp sight; to hear the noise of thunder is no sign of a quick ear. Original Text: 古之所谓善战者,胜于易胜者也。 Translation: Thus the ancients said an excellent winner is one who not only wins but excels in winning with ease.

Original Text: 故善战者之胜也,无智名,无勇功, Translation: Hence his victories bring him neither reputation of wisdom nor credit for courage. Original Text: 故其战胜不忒。不忒者,其所措胜,胜已败者也。 Translation: He wins his battles by making no mistakes. Making no mistakes is what establishes the certainty of victory, for it means conquering an enemy that is already defeated.

Here Sun describes for us what kind of person can be known as an “excellence winner.” This person has trading success based on defense. They make minimal mistakes (i.e., choosing the right time, trend and setting up sensible stop-losses) they also understand that some losses are inevitable while protecting their account for future battles. This kind of success is often very low-key.

It's unlikely to receive any applause or stardom because he or she is not looking to parade their wins in public as it's all part of a more important strategy. Original Text: 故善战者,立于不败之地,而不失敌之败也。 Translation: Hence a skillful commander puts himself into a position which makes it impossible for being defeated and does not miss the moment of defeating the enemy. Original Text: 是故胜兵先胜而后求战,败兵先战而后求胜。 Translation: Thus a victorious strategist only seeks battle after the defense is guaranteed, whereas a losing strategist first encounters a fight and then looks for victory.

These two sentences summarized what we had covered today. First, make sure it is impossible to be defeated (by managing your positions and stop-losses well). In essence, this means even though losses are possible, blowing up an account on a single trade is not.

Seek the most opportune time for a battle (Open a position). Don't just go with the crowd. Do your analysis and study wisely.

Once opened, closely monitor the five elements of the markets ( we covered this in part 1 of this series), then you are heading towards victory. By Lanson Chen – Analyst Lanson Chen @LansonChen This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions.

Trading Forex and Derivatives carries a high level of risk.

What Is The Art Of War? The Art of War is an ancient Chinese book on military tactics and strategy who written by Sun Tzu around 500 BC. These writings are considered by many to be the most significant literature on military tactics and wisdom that can be applied to everyday life ever conceived.

In this multi-article series, we will be interpreting this ancient text, and exploring its application to modern day investing and trading. The whole book has 13 chapters and is only 6,000 characters long, which is relatively concise for such an old and complex language. I will be breaking this down into sections, explaining the meaning behind each phrase and how to apply this to your trading style or strategy.

Military Style Trading Imagine this. You're sitting in front of your screen opening a candlestick chart and trying to figure out the recent patterns and getting ready to place an order. What if you viewed this chart like a military map?

The money in your account is like the soldiers under your command, and the buy or sell orders are like attack or retreat orders. Can you see what I'm hinting at here? —— Trading and War tactics are both arts and similar in many ways. So why don’t we try absorbing some knowledge from the ancient masterpiece?

Perhaps we'll discover some inspirational gems that we can use in our approach to the financial markets. Chapter 1: Strategy Tips: As we progress through the following sections, whenever you see the word “War,” try to replace it with either “Investment” or “Trading” in your head. Explanation: In ancient society, the theory was those who fail to consider strengthening their military force will die.

Nowadays, modern society suggests if you ignore investment principles, you will also die, not physically, but perhaps perish in mediocrity. For example, we all know that since 2008, the wealth inequality gap has become much worse. A vast number of billionaires have emerged, while the middle classes are considerably poorer than one decade ago.

Different Class Different Mentalities One possible explanation behind this is because most rich people tend to invest their money into the stock market or high yielding assets in contrast to the general middle-class who's mentality is geared towards savings and consumption. If Sun Tzu were around today, he'd likely suggest investments over savings. The reason for this is because investing can amplify your wealth if managed correctly, but the method of saving money could be considered a slow death.

Death By Inflation In short, cash in the bank is devalued over time by the act of inflation. While saving money is not necessary a bad thing for some, failing to learn about investing might mean sacrificing opportunities or degrading one's wealth as its value inevitably starts to erode on the sidelines. (1) Tao Explanation: Tao could represent the basic, intrinsic rules of each investment product. For example, the movement of a currency pair (say GBPUSD) is often affected by the fundamentals, news events (such as Brexit) or even just human behavior.

So how can we trade the intrinsic values as the price is always changing? The answer is to find specific patterns or characteristics that are inherent to whatever product you are trading. To do this, you need to explore all the elements and try to make an informed decision as to the possible move in price.

However, given nobody can predict these moves with 100% accuracy, perhaps the only thing we can do is use the following four factors as a guide to help eliminate bad trading habits, and increase the probability of executing profitable trades. (2) Time You can think of this second factor as Fundamentals. As a qualified investor, you should understand what economic data means (such as GDP growth, unemployment, CPI, etc.), What types of events could cause the price to rise and fall (for example you should know how Bond-yield affects the value of USD) As with the cyclical nature of seasons or knowing the exact time of the sunrise and sunset, fundamentals can provide clues as to when we should place a trade based on the upcoming data. This idea is just like a weather forecaster predicting the chances of rain tomorrow.

Keep in mind that the weather, like markets, is not an accurate science and is subject to change. (3) Earth Ea rth or Topography would represent the field of Technical analysis because this method explores the “landform” of a price chart. For example, the highs and lows are like highlands and lowlands in battlefields, with support and resistance lines acting as potential grounds to set up an ambush or mount a defense. By mastering technical analysis, you will be like a commander, studying the geographical features of a map, navigating the terrain and using this knowledge to plan an attack or send reinforcements.

I will use a straightforward chart to illustrate all the factors that mentioned in Sun Tzu's original text. From the chart below, we can see the trend of oil prices is going up, and the most obvious move is to look for an area of value. The idea is to place a buy order while the level is relatively low.

When the price approaches the trend line, perhaps this is a safer place an order? On the other hand, when activity reaches the upper band, in the context of Sun Tzu, it might be considered “too far and dangerous” to keep attacking; thus the best move is to retreat (close your position and take your profit). We'll be discussing more on topography and technical analysis in further chapters. (4) Commander A commander (i.e., investor) should aspire to obtain the characteristics listed above.

If any of these traits are missing, Sun Tzu would perhaps suggest you are more vulnerable to trading losses in the future. Thus, Investment is also a process of exercising yourself to become a better person. (5) Discipline Discipline involves organizing a set of rules to follow while trading and the text would suggest you should not change these on a discretionary basis. Similar to military orders on a battlefield, it is imperative a commander's orders are followed and not disobeyed.

In short, without discipline and proper execution, the fundamental and technical analysis that you apply above will be meaningless. By Lanson Chen - Analyst Lanson Chen @LansonChen This article is written by a GO Markets Analyst and is based on their independent analysis. They remain fully responsible for the views expressed as well as any remaining error or omissions.

Trading Forex and Derivatives carries a high level of risk. Sources: DB Global Markets Research, "The Art Of War" -Sun Tzu.